Our Focus

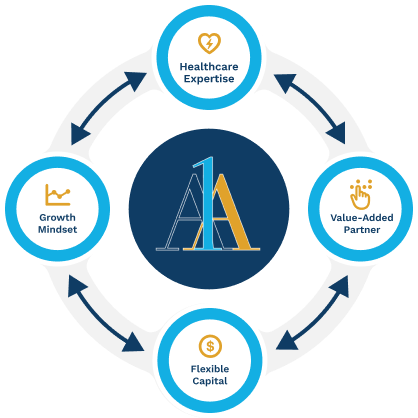

A1A provides debt and equity capital to support healthcare businesses in the lower middle market seeking to scale through organic growth and acquisitions. Our flexible financing solutions span the capital structure and are tailored to meet the capital needs while fostering long-term success.

Our value extends beyond capital. Leveraging our healthcare expertise from decades of investing in the healthcare sector, we provide our partners with insight into navigating and mitigating challenges unique to the healthcare sector while utilizing a robust network of industry leaders to further support our portfolio companies’ missions. Our team and strategic advisors collaborate closely with management teams and stakeholders to augment company resources helping them transform and grow their businesses to drive sustainable value creation. This partnership approach helps our portfolio companies weather any challenge.

Wayne, NJ (Northeast-Focused)

Wayne, NJ (Northeast-Focused)